New to the Inventory Sector? 3 Items to Know Ahead of You Obtain Airline Shares

It is really really hard to discover value on Wall Street suitable now, with indexes in close proximity to all-time highs. But when compared to the froth in a lot of sectors, airways shares glance inexpensive.

You will find excellent cause why these stocks have not rallied along with the broader current market, but does that necessarily mean investors must go on to keep away from the sector?

Below are three issues you have to have to contemplate before purchasing in.

1. The pandemic affect will linger for a long time

Airways ended up among the the sectors most difficult strike by the COVID-19 pandemic, with travel demand from customers evaporating as the virus unfold all around the globe. U.S. carriers noticed income fall by far more than 60% in 2020, and the marketplace only survived thanks to practically $100 billion in federal government assist and non-public fundraising.

We’re in the early stages of a recovery, but it is likely to choose time for airways to bounce back again. Sector execs have stated to expect it to consider years for passenger volumes to return to pre-pandemic degrees, and some popular voices have questioned whether company journey will at any time rebound. International demand figures to trail domestic as countries get well at distinct paces.

A ton of the biggest airlines, firms which includes Delta Air Traces (NYSE:DAL), United Airlines Holdings (NASDAQ:UAL), and American Airlines Team (NASDAQ:AAL), rely on organization vacation for the bulk of their income and will require to substantially revamp their functions if it will not return.

Even in the very best-circumstance scenario the place circumstances normalize speedily, the airlines are likely to will need yrs to fork out down ballooning debt balances and restore other scars from the pandemic prior to they can target on development and expansion all over again.

Impression supply: Getty Photos.

2. It is time to decide on winners

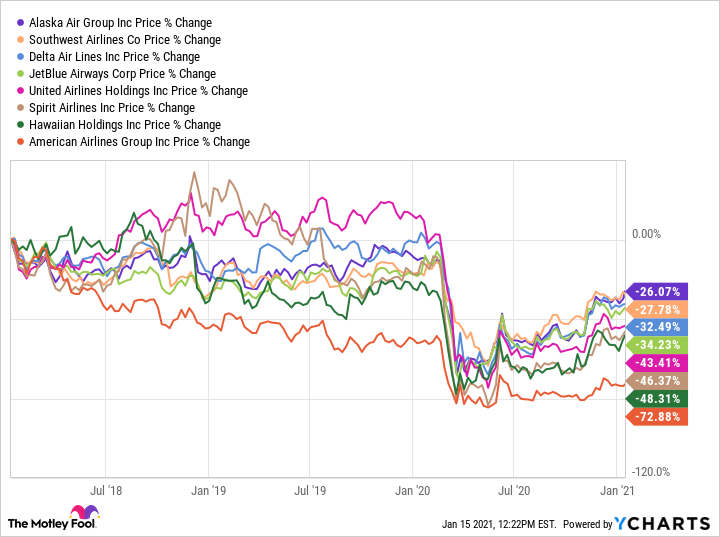

That stated, with the introduction of a vaccine we at least now know there is an conclusion to the crisis in sight. Airline shares generally traded as a group for most of 2020, which manufactured feeling because pandemic-similar anxieties failed to discriminate versus any certain airline. The recovery is unlikely to be as even.

As mentioned above, the larger sized network airlines Delta, United, and American are much more reliant on company travelers. They also have a tendency to have better charges. Delta is the most secure bet between these airways owing to its strong placement prior to the pandemic and the versatility furnished by its mostly non-union workforce, when American came into the crisis with the most credit card debt on its publications and could want for a longer period to get well.

United’s community has very long been the envy of the business because of its aim on small business and global customers, but that route framework will need to be adapted if the airline is to be an early beneficiary of a recovery.

On the other hand, Southwest Airways (NYSE:LUV) has a very long background of getting market place share throughout market downturns and is by now starting to go on the offensive put up-pandemic. Spirit Airways (NYSE:Save) has an business-small expense construction and its route network is previously optimized for leisure vacationers, and is possible to be between the initial airlines to totally get well.

3. This stays a prolonged-phrase expansion story

Prior to the pandemic there ended up a whole lot of tailwinds pushing advancement in the aviation marketplace. Over time, all those forces ought to return.

A growing global center class is more and more searching to journey, and attracting financial commitment, and enterprise travel, to new corners of the globe. A technology of discounters has decreased the expense of vacation, opening it to extra customers and setting up air vacation as a key resource of transportation for a great deal of excursions.

COVID-19 has brought those developments to a halt, but it should really be temporary. Aircraft maker Boeing dramatically lowered its 10-year delivery forecast thanks to the pandemic but held its 20-yr forecast intact, implying it sees a full recovery more than time.

The option for growth continues to be significant. The Intercontinental Air Transport Affiliation forecasts overall world-wide passenger rely will mature from 3.9 billion in 2019 to 8 billion by 2039, and said the selection could be as significant as 11 billion passengers in its most bullish scenario. Even in its bearish circumstance wherever air travel is lessened put up-pandemic and owing to carbon taxes and other coverage improvements, the trade group even now expects a in the vicinity of doubling in passenger volumes in 20 yrs.

The bottom line is, air vacation is not likely everywhere, and even if you are bullish on Zoom Video clip Communications and the like replacing some chunk of business travel, there ought to still be enough need in the years to appear.

Investor takeaway: Be cautious, but not afraid

I am bullish on airways, but it is an open issue how extended it will take for the bullish guess to pay off. For now, I might hope an uneven recovery, with shares pulled concerning optimistic and pessimistic pandemic information and the outlook for the broader economy.

It’s very not likely we are going straight up from here.

For buyers in a position to belly turbulence and emphasis on the extensive phrase, it is a fantastic time to commence positions in some of the top names in the field. Spirit appears to be like like a good wager to be a winner about the upcoming 12 months, and Southwest and Delta are the very best candidates to acquire and keep without end.